International sales growth remains mostly volatile. But as financial reports show, growth rates have decreased for many. Be it in the US or in Europe, especially domestic-bound retailers and brands stumble.

Global expansion in sales and distribution competence has become a lifesaving strategy feature, but allow me a question first:

Is your reporting of sales and distribution in global expansion mostly focused on international sales and profits only? Yes? Now, when you travel abroad, do you still use a road atlas to find your way? No, that would feel a little last century, wouldn’t it?

(Graphic: Brand Pilots)

By the same token, why do you still use last-century KPIs to determine success in international sales growth and distribution? As you might know, this turns a blind eye on the potentials you leave out.

We have the 2020s, and it’s time to get on board with newer ways of measuring success in sales and distribution growth. Let’s have a look at three typical annual business situations and how new ways of addressing international expansion leads to different growth priorities.

Canada Goose, lately beaten by the stock market for only growing 25% (Photo: Canada Goose)

A New Way of Reporting International Sales Growth and Distribution

Let’s be honest, most of us measure success based on sales and international sales growth. Because we always did, and that’s how shareholders want to hear it. Reports show your large distribution countries as the most important, and fast-growing countries as the most successful ones. So 95% of our sales discussions concern our ‘as is’ instead of our ‘could be’. We look at yesterday’s achievements in global expansion instead of tomorrow’s potential, and overlook that the revenue potential of a small sales unit is often far larger than that of our largest sales units. If we don’t see it, will we address it in our annual strategic planning?

Tip 1: Start reporting market potentials and your market shares.

Yes, reporting market shares may be uncommon in the lifestyle industry. But is there a more motivating way to report your upside potential in a market? And if you lack benchmarks, just pick the country with your strongest market share to advance the others. If we can do it in country X, what do we need to follow suit in other countries?

And there is more to market share reporting. When you see that five large distribution countries have a similar market share as your home country, you know you are international expansion ready.

A New Way of Studying International Sales Growth and Distribution

How do you find your relevant market potential and the biggest market? The global expansion of the most successful lifestyle brands has passed 100 countries, some are even close to passing 200.

Adidas, Phnom Peng, Cambodia. Not necessarily your usual priority country (Photo: Brand Pilots)

That’s nice to know for your international sales growth and distribution strategy, but no orientation on where you should go next in your own international expansion. What are the most attractive markets that perfectly fit, how do you find them, and how do you enter those markets?

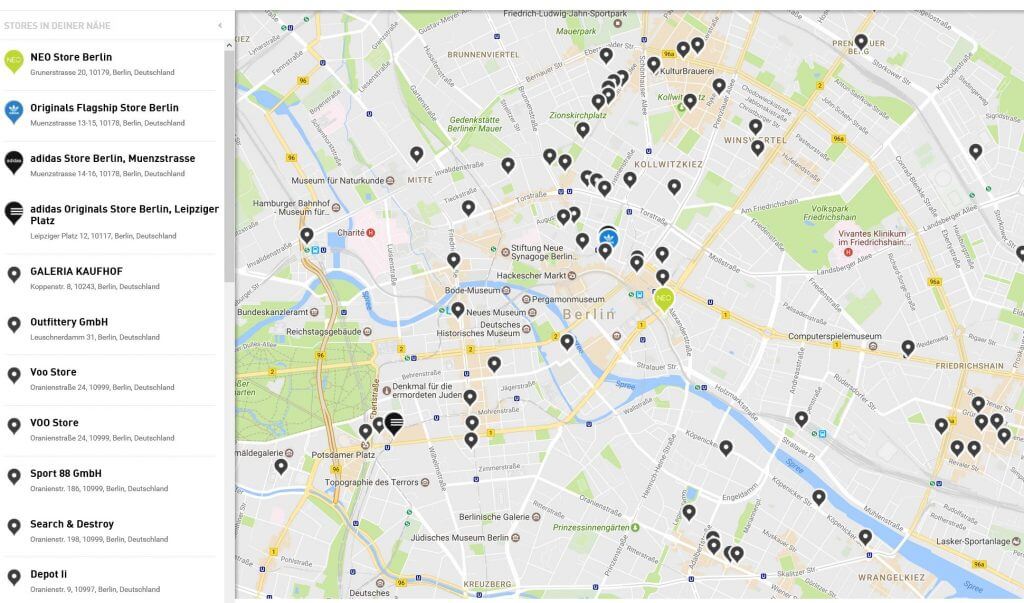

Tip 2: Study your competitor’s store locator

Last century, you read (biased) retail real estate reports or bought retail studies to learn about the next big countries for global expansion. Do you remember the BRIC hype and the myriad of studies proclaiming future growth? Are India or Brazil big in your portfolio, and did you grow or shrink Russia since then?

The new way of studying a potential market is to analyse POS growth of your peer group and competitors in store locators and Google Maps.

Store locators, like this one from Adidas, are always a good source to read market potentials (Source: Adidas)

Report your peers’ and competitors’ online appearance, social media, and store locator growth, and you will know more of what is happening in global expansion than the best study can tell you. And if customized for your brand, it tells you more about expansion potential than any third-party study can. One annual report and you know what is happening in your peer group and where to go next. You will see perspectives and upside potential in international sales growth and distribution rather than just your status quo.

Jack Wolfskin, another brand prioritizing growth from international expansion to shrink home market dependency (Photo: Brand Pilots)

Global Expansion dare to risk something

I have been involved in around 50 brand growth planning processes, the first one for Levi’s in Asia in 1995. Many things have changed since then, but one thing hasn’t: planning is a process where managers come together, share their financial achievements and ‘battle’ for investments in ‘their’ market to secure next year’s growth.

Levi’s in Seattle, a brand that focused on international expansion early on (Photo: Brand Pilots)

In the weeks that follow, the finance department and the board review sales and distribution plans and decide who gets a thumbs up, who needs to wait another year, and who is sent to consolidation street. The new investment strengthens international sales growth muscles in global expansion that were strong already. That is very logical because whoever delivered on their plan last year is likely to deliver next year too.

The only problem with that approach: If you continue to train well-developed muscles instead of underdeveloped ones, you expand around your church tower. You risk turning into a very unbalanced organization – likely one of those mostly domestic-bound brands that tend to stumble. And over time, you forget how to challenge yourself and take a risk.

S.Oliver in Vienna, a successful German brand struggling for years to lose its home market dependency (photo: brand pilots)

Tip 3: Reduce investment priorities where you are already successful

Instead of making country managers fight for their investment share and having nothing left when you budget, decide upfront what amount to put aside to secure strategic market investment. You’ve done this for years for your infrastructure, to develop your logistics, IT and online. Do it for markets and international expansion too. So this year, instead of investing 90% in already successful countries, spend 1/4 to uplift existing markets with low market share and high potential.

Practice New Century Expansion Reporting

I have been working global expansion in 40+ countries just in the last two decades. I was lucky to witness many small and big best practices, and if there is one thing I have learned: focusing on international sales growth and distribution reports to judge about a local brand organization is like judging a person’s health by the kilos on the scale– you just see the volume, not the health. You do not understand the true state of global expansion. Wherever you can, stop ‘sales-only’ reports, and demand smart qualitative information before.

Encourage your organization to become smarter in information on global expansion gathering. Next time somebody is asking to buy a study, ask for online profiles and brand store overviews of your peer group first.

But above all, utilize your management skills, by travelling abroad, meeting people, learning on the ground. At least one new country every six months. Travel there alone, with your management team, or call, and we travel together. But most importantly, travel.

Trust me, this will give your brand’s growth and international expansion so much more in return.

About the Author

Guido travels far on his global brand and retail mission, but his two absolute favourite destinations, Oman and Laos, are unfortunately not a brand expansion priority yet. He loves those countries, especially for being global brand latecomers. Contact him to prepare your growth travel or connect with him on LinkedIn.